What is a Form 1095-C?

February 29, 2024

Learn everything you need to know about Form 1095-C, including what it contains, how to file it, and what the penalties are for noncompliance.

- Reviewed by Paylocity's Compliance & Government Relations Team

What is the 1095-C Form?

The Employer-Provided Health Insurance Offer and Coverage form, also known as Form 1095-C, is a tax form required by the Affordable Care Act's (ACA) Employer Mandate.

Applicable Large Employers (ALEs) issue the form to their full-time employees and the Internal Revenue Service (IRS) for two reasons:

- First, the form fulfills an employer's ACA reporting requirements by providing details about the coverage they offered their employees.

- This includes when during the year the coverage was available and if the coverage extended to the employee's dependents.

- The IRS uses this information to determine if the offered coverage meets the ACA's plan requirements on affordability, availability, and value.

- Second, the form gives employees information they'll need when filing their tax returns for the year, including:

- What coverage their employer offered that year.

- Whether they're eligible for a Health Insurance Marketplace premium tax credit based on that offered coverage.

Key Takeaways

- Form 1095-C is a tax form used to verify an employer's compliance with the Affordable Care Act's Employer Mandate.

- The form contains information about the employer-offered health care coverage, the months in which the coverage was available, and any of the employee's dependents who received it.

- Employers must provide copies of the form to all full-time employees and the Internal Revenue Service by strict deadlines or face fines.

Related ACA Reporting Forms

When it comes to health insurance reporting, tax forms are sometimes interconnected to help supplement or expand upon the information being submitted. Form 1095-C is no different, as the following related forms are often grouped with it.

Form 1094-C

Since an employer must submit a 1095-C form for each of their employees, the 1094-C form is submitted as well to summarize all the 1095-C information being reported.

In a sense, Form 1094-C acts as a cover sheet by condensing the aggregate 1095-C information for the employer's plan. This includes the total number of 1095-C forms being submitted, the total number of employees within the organization, and whether the employer offered health insurance with minimum essential coverage.

Form 1095-B

Another related form is the 1095-B form, which also serves two purposes:

- On the one hand, it supplements the 1095-C form with additional information, such as the types of offered coverage an employee chose to enroll in and what coverage their dependents received.

- On the other hand, Form 1095-B can instead serve the same purpose as the 1095-C form, but for small employers or those who provide self-insured coverage (i.e., coverage where employees pay medical expenses directly instead of ongoing medical premiums).

Form 1095-C Contents

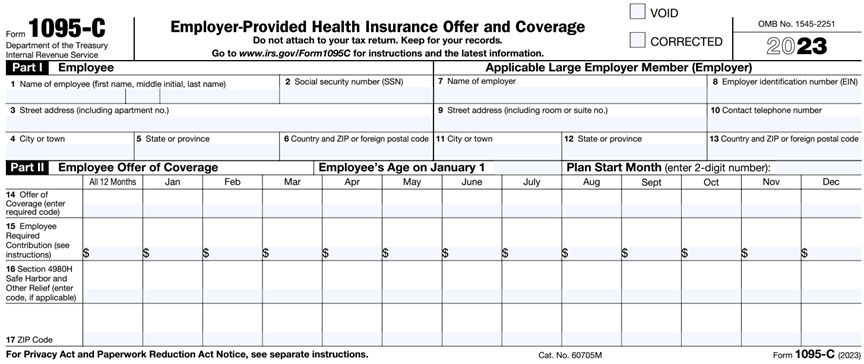

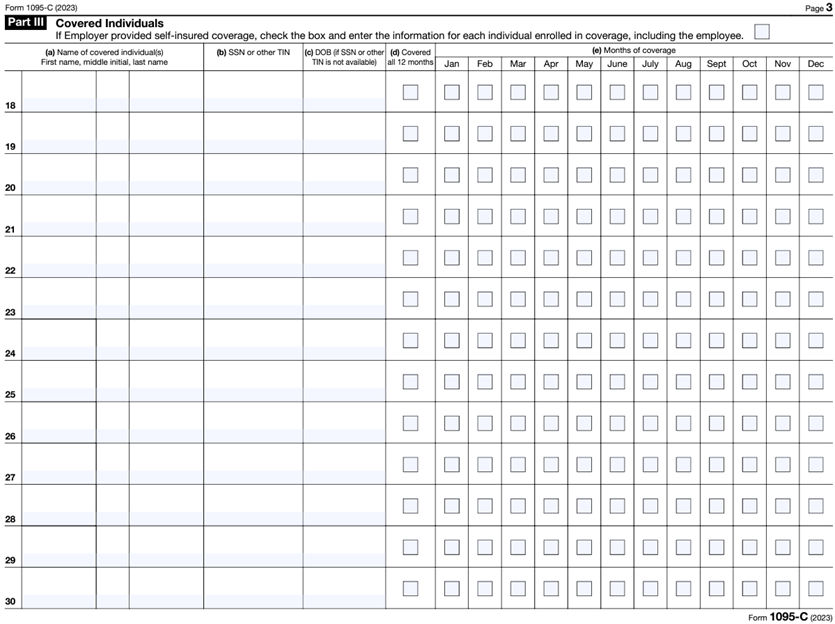

IRS Form 1095-C breaks reported information down into three sections, each focusing on a different aspect of the offered plan:

- Part I: Basic information about the employee and employer, including their names, physical addresses, and identification numbers (i.e., SSN or EIN).

- Part II: Details about the plan itself (e.g., which month the plan year begins), the employee's age on January 1 of the reporting year, and the months during which the employee was eligible to participate.

- Part III: Lists information for every person enrolled in the employer-offered plan, including the employee, their spouse, and any dependent(s). The information includes each person's name, date of birth, taxpayer identification number, relationship to the employee, and months of coverage.

Form 1095-C Codes

Part II has a wide range of 1095-C codes it can use to indicate the kind of coverage an employer offered its employees and/or what kind of coverage the employee received:

| Code | Details |

| 1A | Qualifying Offer was made (i.e., minimum essential coverage providing minimum value was offered to full-time employees with the Employee Required Contribution being equal to or less than 9.5% (as adjusted) of the mainland single federal poverty line and at least minimum essential coverage offered to spouse and dependent(s)). |

| 1B | A plan that offered minimum essential coverage to the employee and had at least a minimum value to the employee only. |

| 1C | A plan that offered minimum essential coverage to the employee, had at least a minimum value to the employee, and offered at least minimum essential coverage to the employee's dependent(s) only. |

| 1D | A plan that offered minimum essential coverage to the employee, had at least a minimum value to the employee, and offered at least minimum essential coverage to the employee's spouse. Use code 1J instead if the spouse's coverage was offered conditionally. |

| 1E | A plan that offered minimum essential coverage to the employee, had at least a minimum value to the employee, and offered at least minimum essential coverage to the employee's spouse and dependent(s). Use code 1K instead if the spouse's coverage was offered conditionally. |

| 1F | A plan with minimum essential coverage that didn’t provide minimum value was offered to the employee, the employee and their spouse or dependent(s), or the employee, their spouse, and their dependent(s). |

| 1G* |

Coverage was offered for at least one month of the calendar year to an individual who was either:

|

| 1H | The employer didn't offer any coverage or offered a plan without minimum essential coverage. |

| 1J | A plan that offered minimum essential coverage to the employee, had at least a minimum value to the employee, and conditionally offered at least minimum essential coverage to the employee's spouse. |

| 1K | A plan that offered minimum essential coverage to the employee, had at least a minimum value to the employee, offered at least minimum essential coverage to the employee's dependent(s), and conditionally offered at least minimum essential coverage to the employee's spouse. |

| 1L | The employer offered an individual coverage Health Reimbursement Arrangement (HRA) to only the employee that's affordable based on the ZIP code of the employee's primary residence. |

| 1M | The employer offered an individual coverage HRA to only the employee and their dependent(s), that's affordable based on the ZIP code of the employee's primary residence. |

| 1N | The employer offered an individual coverage HRA to the employee, their spouse, and their dependent(s) that's affordable based on the ZIP code of the employee's primary residence. |

| 1O | The employer offered an individual coverage HRA to only the employee that's affordable based on the ZIP code of the employee's primary employment site. |

| 1P | The employer offered an individual coverage HRA to only the employee and their dependent(s), that's affordable based on the ZIP code of the employee's primary employment site. |

| 1Q | The employer offered an individual coverage HRA to the employee, their spouse, and their dependent(s) that's affordable based on the ZIP code of the employee's primary employment site. |

| 1R | The employer offered an individual coverage HRA to the employee, the employee and their spouse or dependent(s), or the employee, their spouse, and their dependent(s) that wasn't affordable. |

| 1S | The employer offered an individual coverage HRA to someone who wasn't a full-time employee. |

| 1T | The employer offered an individual coverage HRA to the employee and their spouse, not dependents, that's affordable based on the ZIP code of the employee's primary residence. |

| 1U | The employer offered an individual coverage HRA to the employee and their spouse, not dependents, that's affordable based on the ZIP code of the employee's primary employment site. |

*Applies for the entire year or not at all

How to File a 1095-C Tax Form

Employers must furnish copies of the 1095-C tax form to all full-time employees (even those who didn't enroll in the coverage) by March 1, 2024. In other words, each form must be properly addressed and mailed or uploaded and available for employee access by that date. For tax year 2023, Form 1095-C instructions specify that employers aren't allowed to request any extensions past that due date.

In contrast, employers are given some leeway when it comes to submitting forms 1094-C and 1095-C to the IRS. First, the IRS requires employers filing 10 or more 1095-C forms to do so electronically via its ACA Information Returns (AIR) program. Although, even if an employer has fewer than 10 forms, the IRS still recommends electronic filing over mailing printed copies.

Secondly, printed copies must be mailed by February 28, 2024, while electronic copies must be submitted by April 1, 2024. Employers can apply for a 30-day extension by submitting Form 8809 on or before the applicable deadline. In some cases of hardship, an additional 30-day extension can be requested as well.

Regardless of how the forms are submitted, the IRS also generally recommends ALEs keep copies of each information return (or have the ability to reconstruct the data in them) for at least 3 years from the return’s due date.

Penalties for Noncompliance

ALEs can face expensive finesopens in a new tab for either failing to meet the above deadlines or submitting forms with inaccurate information. In fact, the IRS may assess a penalty of $310 per form (up to the annual maximum of $3,783,000) for failure to comply with any of the following:

- File an information return (e.g., Form 1095-C)

- File 10 or more information returns electronically

- Provide full-time employees or the IRS with a correct payee statement

Fortunately, these penalties can be waived if an ALE can prove there was a reasonable cause for the failure. Of course, if the ALE intentionally disregards these ACA filing requirements, these amounts can increase.

ACA Filing Assistance

The larger an organization becomes, the more time-consuming and expensive filing ACA information returns can be. That's why Paylocity's Compliance Dashboard is designed to help you track and manage all the various ACA forms, returns, and submissions you face every year.

Request a demo today to see firsthand how this platform can empower you to efficiently monitor your ACA requirements and costly penalties.

Get Taxes Done Right, Without the Stress

We know there's a lot that goes into preparing and filing payroll tax forms. Save time and get support from our expert team. As a Registered Reporting Agent with the IRS, we can help prepare and file all the necessary forms you need to remain compliant - even in the face of changing legislation. Learn more here.