We know that nearly 80% of U.S. workers live paycheck to paycheck, and 1 in 4 don’t set aside monthly savings. With our proprietary On Demand Payment solution, you can offer your employees an alternative to pay advances and high interest payday loans. On Demand Payment provides early access to a portion of earned wages during the active pay cycle (before the scheduled payday), without additional paperwork, special permission from HR or managers, or changes to your payroll processes and cash flow.

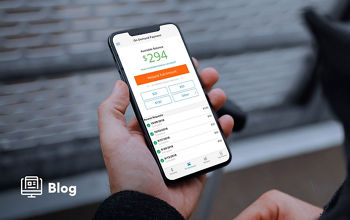

On Demand Payment Solutions

Attract and Retain Talent

How it Works

Helping You Attract and Retain Talent

Frequently Asked Questions

On demand payment allows employees to obtain a portion of their wages as they acquire them throughout their pay period. As an employer, you can opt into this feature and choose which employees have access to it. Employees can then request advanced wages as needed.

On demand pay offers the opportunity for employees and employers to be flexible with wages in multiple ways:

For employees: On demand wages allow access to a portion of earned money when they need it most, in advance of the next regularly scheduled pay date. This provides more financial security and flexibility for an employee when dealing with unexpected financial situations.

For employers: Payment on demand can provide greater employee retention and satisfaction by helping reduce financial burden as needed. Advanced wages can also be an enticing perk for hiring candidates in a competitive talent market.

It’s easy to offer, too! Paylocity’s On Demand Payment solution takes care of the logistics – Funds come from earned wages as well, so there’s minimal impact on your usual payroll processes.

Read more about the benefits of on demand payment in our resource library.