Receipts and expense reports can pile up quickly, and in today’s increasingly hybrid work environment, paper introduces logistical challenges. Paylocity’s expense tracking solution is simple for employees to use and eliminates the need for spreadsheets, calculators, and signatures by digitizing the process of submitting, approving, and reimbursing employee expenses.

Expense Management Software

Expense Reimbursement Made Easy

How Expense Simplifies Submission, Approvals, and Reimbursement

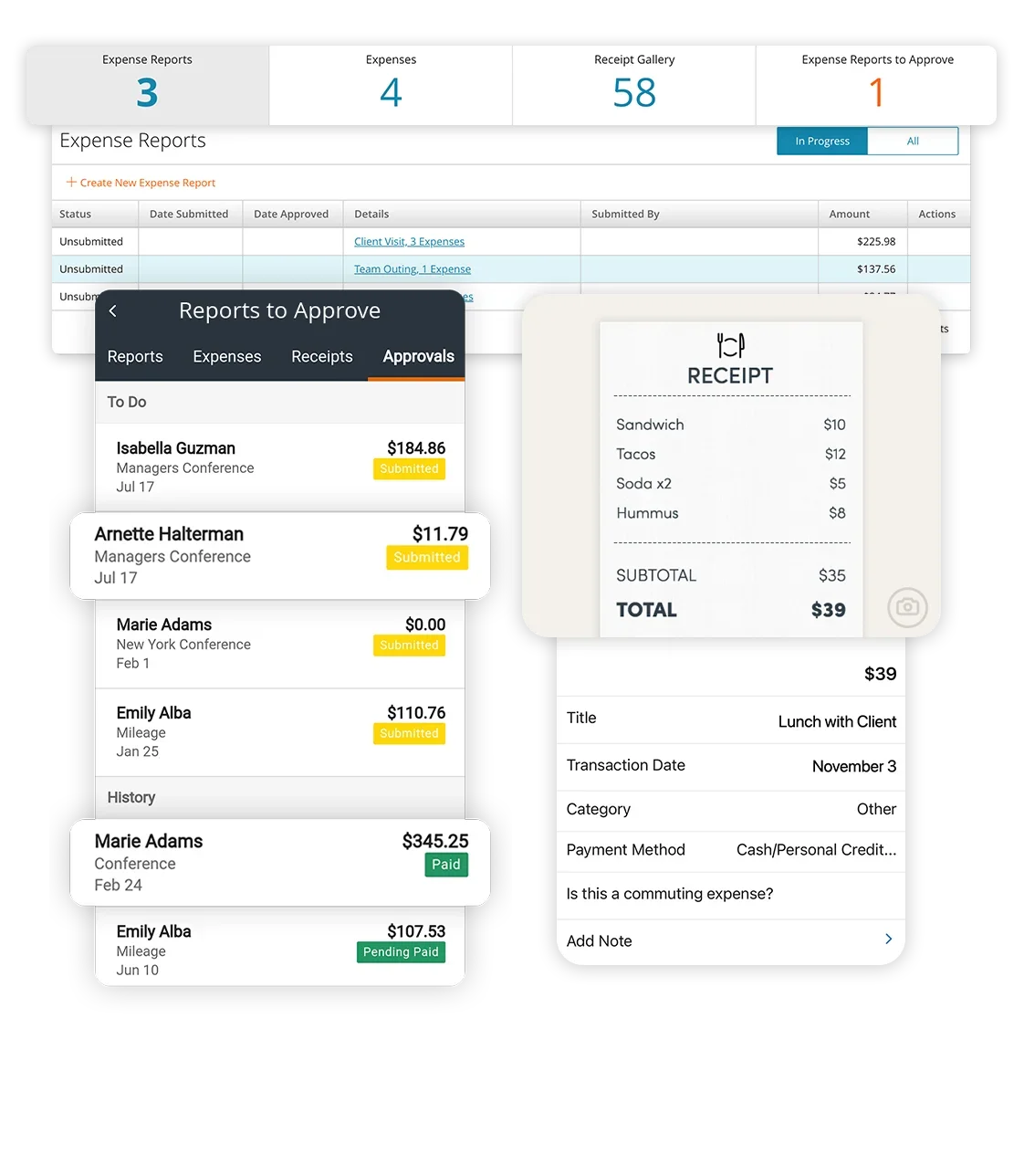

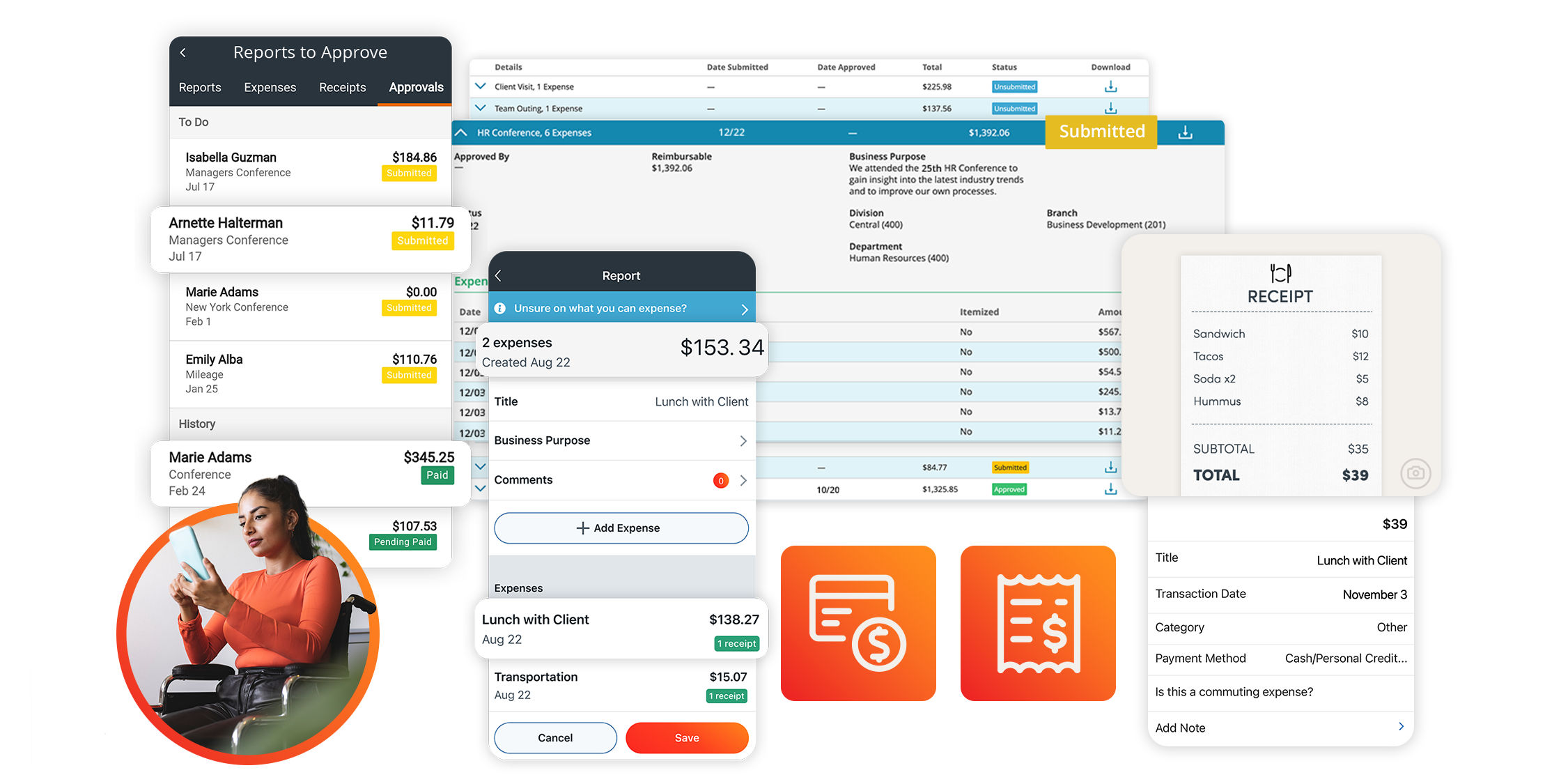

Submit and Approve from Anywhere

Employees can use Paylocity’s mobile app to upload receipts and track expenses on-the-go. Supervisors can easily review and approve expense reports directly in an employee’s record

Improve Accuracy and Reimburse Faster

Minimize incorrect entries or forgotten expenses by letting employees link a company or personal credit card. They can even track mileage expenses by entering a starting point and a destination like in Google Maps. Employees and approvers can receive automated notifications to keep the process moving along and provide ongoing status updates.

Analyze Trends and Reports

Access out-of-the-box reports and get tailored insights into spending by department, approvals outside of policy, and overall spending patterns.

Frequently Asked Questions

Expense management software automates the submission, approval, and reimbursement of employee expenses. Utilizing software to submit and approve expenses can reduce the likelihood of errors, expedite reimbursement, and improve compliance.

Global businesses and small businesses alike benefit from automated expense management. These businesses choose expense management software for several reasons:

- To improve the user experience for employees submitting expenses.

- To reduce the amount of time employees and managers spend on expense reports.

- To reduce how long it takes for employees to be reimbursed for their expenses.

- To improve expense tracking.

- To improve compliance with expense reimbursement policies.

To manage expense reports:

- Develop a policy that outlines covered expenses and the deadlines and process for submission and payment.

- Implement expense management software to streamline and simplify the process.

- Ensure all expense reports are reviewed and approved by a supervisor.

- Audit a percentage of expense reports quarterly for compliance with policy and IRS guidelines.